Chinese Refrigerator&Freezer Industry Analysis

- TRUECOOLTECH

- Aug 16, 2022

- 3 min read

Updated: Aug 27, 2022

1. Refrigerator output in China

Refrigerators are the equipment used for low-temperature preservation of food and other items, which can be generally classified for domestic and commercial use. Commercial refrigerators can be applied in restaurants, water bars, food processing and supermarkets. In 2021, Chinese domestic refrigerator output was 29.06 million units, decreased by 4.5% compared with 2020.

According to the National Bureau of Statistics, East China produced the most refrigerators in 2021, accounting for 67.9 percent of the total production.

Among them, Anhui produced the most domestic refrigerators in 2021, followed by Shandong Province which produced 7,819,500 units of domestic refrigerators.

2. Refrigerator sales

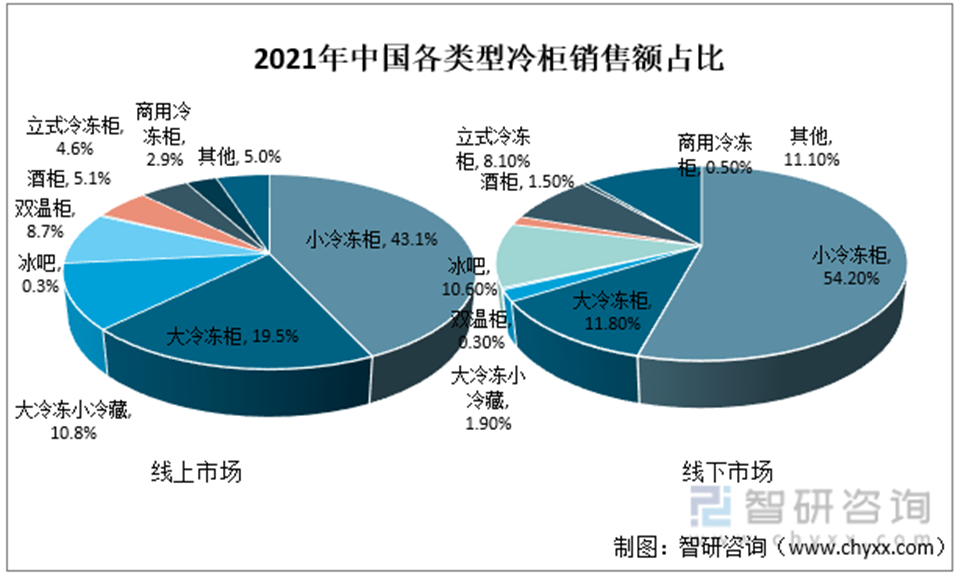

In the online market of refrigerators in China in 2021, small refrigerators are in the best market, accounting for 43.1%; The offline market also has the largest sales of small refrigerators, accounting for 54.2% of the sales.

In terms of distribution channels, with the normalization of epidemic prevention and control, the offline market is still in recovery, while the online market continues to grow with a high base. Among the sales of refrigerators in China in 2021, e-commerce sales accounted for 33.5%.

Since 2020, the price of raw materials in the household appliance industry has been rising, which then fell back in May of 21. At present, the offline growth is maintained at a high level; However, due to the rising operating costs in the offline market, the operating pressure has been expanded.

3. Refrigerator sales analysis

With gradual saturation of traditional commercial refrigerator market, upgrading and optimization of existing refrigerator has incurred major fight between various enterprises. More and more new technology and new material are applied to commercial refrigeration industry, which led to tremendous change in product structure. Realizing the drawback of swinging with the tide, Chinese enterprises paid great attention to product innovation and finally met market demand. In 2020, China's refrigerator output was 37.167 million units, with a year-on-year growth of 36.7%; refrigerator sales in China reached 37.2 million units, increased by 39.7 percent year on year.

In order to stand out in the increasingly fierce competition, many enterprises began to make efforts to explore new markets. Horizontal cabinets, vertical cabinets, variable temperature cabinets, wine cabinets, ice bars, breast milk cabinets and other products emerged in, stimulating consumer demand. In 2020, the sales volume of small and medium-sized freezers in China was relatively high. The online sales of small freezers accounted for 50.68% while offline sales accounted for 65.43%.

The main sales channels of refrigerators are still offline market, but the online market has greater control over the cost of products, which can provide consumers and businesses with greater profitability.

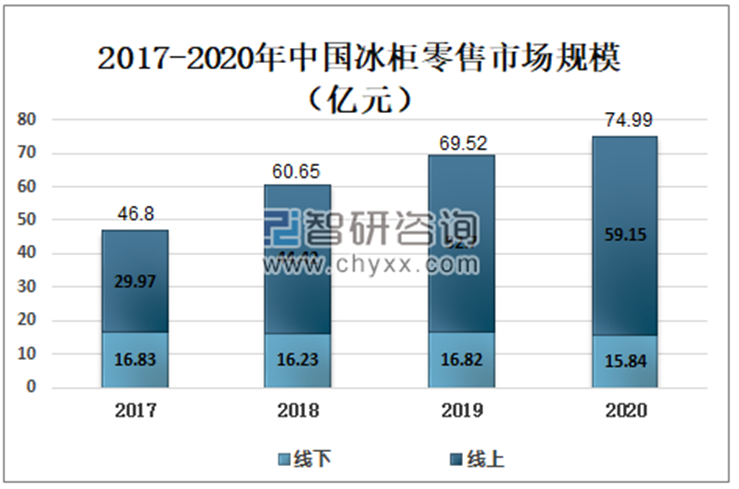

In recent years, the scale of China's refrigerator retail market has increased year by year. In 2020, the scale of China's refrigerator retail market was 7.499 billion yuan, with a year-on-year growth of 7.9%.

4. Import-export analysis

As one of the major machinery producers, China has greater refrigerator export than refrigerator import. In 2020, the export quantity of freezers in China was 282.09 million, decreased by 1.8% year on year; China imported 5.9 million refrigerators, increased by 5.4 percent year on year.

According to Chinese customs data, in 2020, the amount of China’s refrigerator import was 976.52 million US dollars, decreased 12.2% year on year; the value of China’s refrigerator exports was $11,171.16 million, increased by 7.5% year on year.

Data source: National Bureau of Statistics, Zhiyan Consulting

Quote:

Comments